Enphase Energy vs. Woodside Energy: A Long-Short Strategy for Diverging Energy Markets

Discover a long-short strategy capitalizing on renewable energy growth with Enphase (ENPH) and fossil fuel risks with Woodside (WDS). Explore valuation gaps, market trends, and an opportunity for balanced returns.

Hello everyone,

Today we present a long short between renewable energy and oil and gas sector. This long-short thesis builds on the diverging trends between renewable energy and fossil fuels, valuation misalignments, and the financial and strategic positions of Enphase Energy (ENPH) and Woodside Energy Group (WDS). While Enphase benefits from structural tailwinds in renewable energy adoption, Woodside is exposed to the longterm decline in hydrocarbon demand, volatile commodity prices, and valuation risks.

Enphase Energy (ENPH) is a U.S.-based renewable energy technology company specializing in solar microinverters, energy storage systems, and smart energy management solutions. Its innovative microinverters convert solar-generated DC power into AC electricity, enhancing efficiency and reliability for residential and commercial solar installations. Enphase benefits from rising global demand for clean energy and government incentives but faces risks from interest rates, competition, and supply chain pressures.

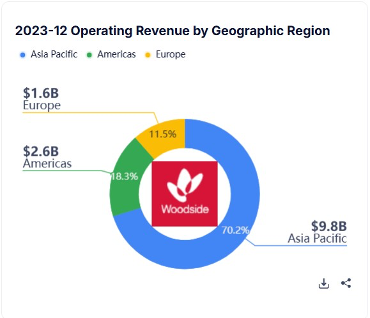

Woodside Energy Group (WDS) is an Australian-based energy company primarily engaged in the exploration, production, and sale of oil and natural gas. It is one of Australia’s largest independent energy producers, with significant operations in liquefied natural gas (LNG), particularly across Australia and the Asia-Pacific region. WDS generates a substantial portion of its revenue from LNG exports, benefiting from longterm contracts and growing global demand for natural gas as a transition fuel. The company is focused on expanding its portfolio through major projects, including offshore developments and acquisitions, while cautiously exploring opportunities in low-carbon solutions like hydrogen and carbon capture. Woodside faces risks tied to commodity price volatility, geopolitical factors, and environmental regulations, but its strong cash flows, dividends, and LNG market positioning offer resilience and stability.

Enphase Energy (ENPH)

Growth Drivers in Renewable Energy

Residential Solar Adoption: Global decarbonization goals, higher electricity prices, and government incentives (e.g., the U.S. Inflation Reduction Act and European Green Deal) are driving residential solar installations, with a growth rate of 20%.

Energy Resilience: Increasing grid instability and demand for backup power systems are boosting demand for Enphase’s microinverters and battery storage solutions.

Market Leadership and Differentiation

Microinverter Technology: Enphase is the market leader in microinverters, offering:

o Higher efficiency and panel-level optimization.

o Ability to function during power outages (with IQ8 technology).

o Easier installation and scalability, compared to string inverters (used by competitors like SolarEdge).

Integrated Ecosystem: Enphase’s offerings extend beyond microinverters to include storage batteries, energy management systems, and EV chargers, enhancing its competitive moat and ability to cross-sell.

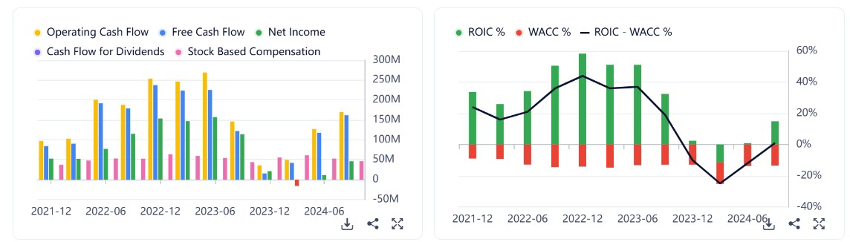

Profitability: Even with revenue decline in 2023, ENPH shows resilience and we can see here a turning point in revenue growth. It´s gross margins of 40% are well above peers due to its premium pricing and low production costs.

Enphase outsources manufacturing, enabling rapid scalability and low capex requirements, with FCF margins of 27%. ENPH has been able to maintain positive net income and strong FCF despite declining revenue in 2023.

Changes in Interest Rates

Residential and commercial solar systems often rely on loans, leases, or financing plans to reduce upfront costs. Falling interest rates make financing cheaper, driving greater adoption of solar energy systems. ENPH, as a supplier of microinverters and energy storage solutions, benefits from this increased demand.

Lower interest rates improve the economics of solar installations, especially in long-term payback scenarios, making solar projects more attractive relative to traditional energy options, improving return on investment for Solar Projects.

On the other hand, rising interest rates or narrative of higher for longer, could increase financing costs for residential solar customers, slowing adoption.

Woodside Energy Group (WDS)

Fossil Fuel Decline and Transition Risk

Global decarbonization efforts threaten long-term demand for oil and gas. Key markets are accelerating transitions to renewables, eroding the fossil fuel growth narrative.

Woodside's large natural gas exposure (LNG 60% of revenue) faces stiff competition from renewable energy sources and battery storage in power generation.

Oil Price Volatility

WDS remains heavily dependent on volatile oil and gas prices, which have declined significantly in recent months amid global oversupply and economic uncertainty.

OPEC+ production cuts and competition from U.S. shale could create further supply-side instability.

High Dividend Payout is unsustainable

WDS offers an appealing dividend yield (7%), but the payout is heavily reliant on high commodity prices. As prices normalize, dividend cuts could lead to share price underperformance.

Decarbonization Goals: Governments worldwide are accelerating renewable adoption, targeting net-zero emissions by 2050. This directly reduces demand for hydrocarbons.

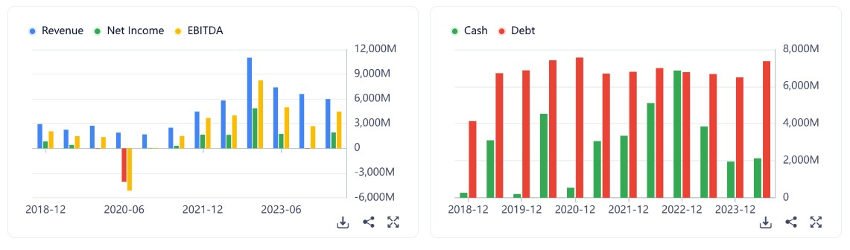

As we can see below, debt of WDS has been growing and is three times the amount of cash. This is due to some recent acquisitions by WDS but could present some risks. With high interest rates, WDS could see it´s interest expenses rise.

2. Commodity Price Dependency

Woodside's financial performance is highly sensitive to volatile oil and natural gas prices:

Oil prices have fallen from 2022 highs of $120/barrel to $70/barrel, with limited upside due to slowing global demand and recession risks.

Gas prices, a key market for Woodside, have normalized after the 2022 spike caused by the Russia-Ukraine conflict and they are at 2 years high.

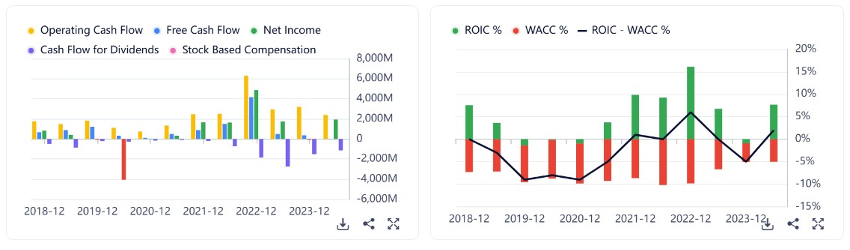

Lower commodity prices directly compress margins and reduce free cash flow, as we can see below. WDS is very inconsistent in terms of operating cash flow generation.

Balance sheet risks and High Capex Requirements:

Woodside's high capital expenditures on LNG projects and declining free cash flow threaten its financial flexibility, especially as borrowing costs rise.

Offshore oil and gas projects require significant capex, with declining returns on invested capital (ROIC).

Geopolitical Exposure

As we can see below, 70% of WDS revenue comes from Asia Pacific. Woodside's operations in Australia and the Asia-Pacific region are exposed to geopolitical uncertainties (e.g., trade tensions with China and regional instability).

Conclusion

This long short capitalizes on the structural divergence between renewable energy growth and declining hydrocarbon demand:

Enphase (ENPH) is a great renewable energy company with strong growth, market leadership, and attractive upside potential at current valuations.

Woodside (WDS) is a legacy fossil fuel company with limited growth, overreliance on commodity prices, and long-term existential risks from the energy transition.

Long Short

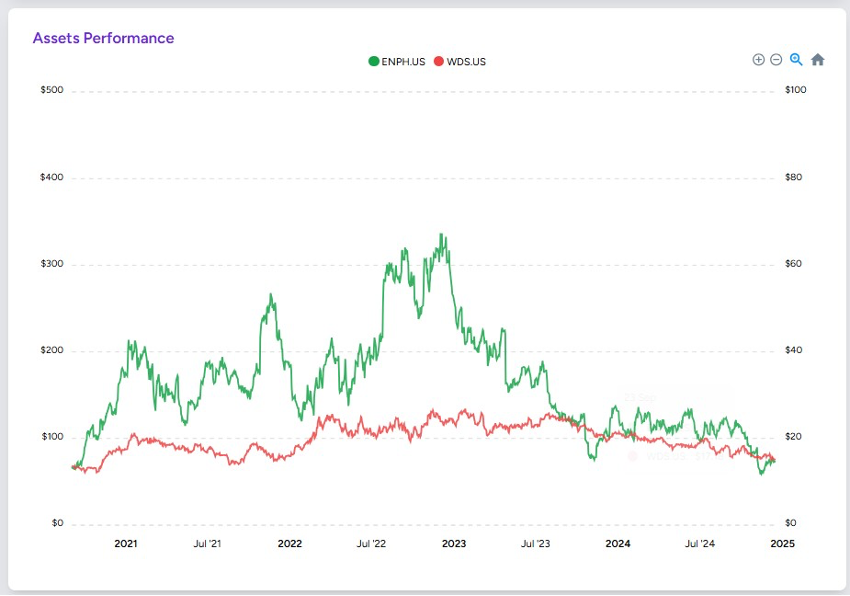

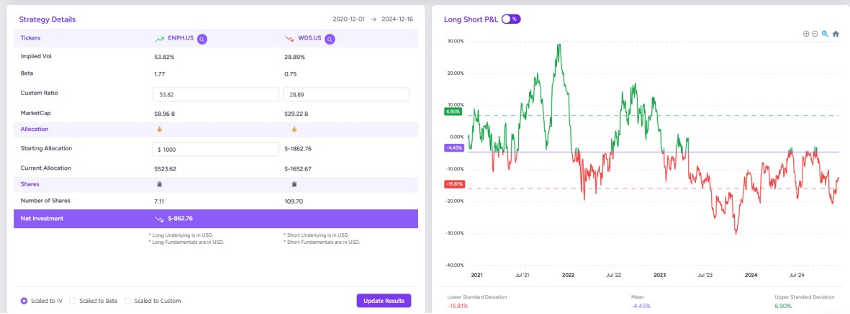

This long-short strategy, which began on December 1st, 2020, and goes on until December 16th, 2024, demonstrates correlation between Enphase (ENPH) and Woodside (WDS) even though they belong to different sectors. Throughout this period, the stocks have reverted to their mean several times, enabling the strategy to generate attractive returns. With an initial investment of $1,000, the current allocation consists of going long 7.11 shares of ENPH and shorting 109.70 shares of WDS, resulting in a net credit of $1,129.05. The strategy is scaled based on implied volatility, as ENPH has a higher IV at 53.82% compared to Woodside´s 28.89%, ensuring balanced risk exposure and preventing the higher volatility of Enphase Energy from dominating the portfolio.

As we can see below, there have been some unusual options activity in both stocks. In ENPH we can see some mixed sentiment in the UOA flow, however, with some bullish flow in the last days. This could be a way to capitalize on this long short, combining fundamental data with technical flows.